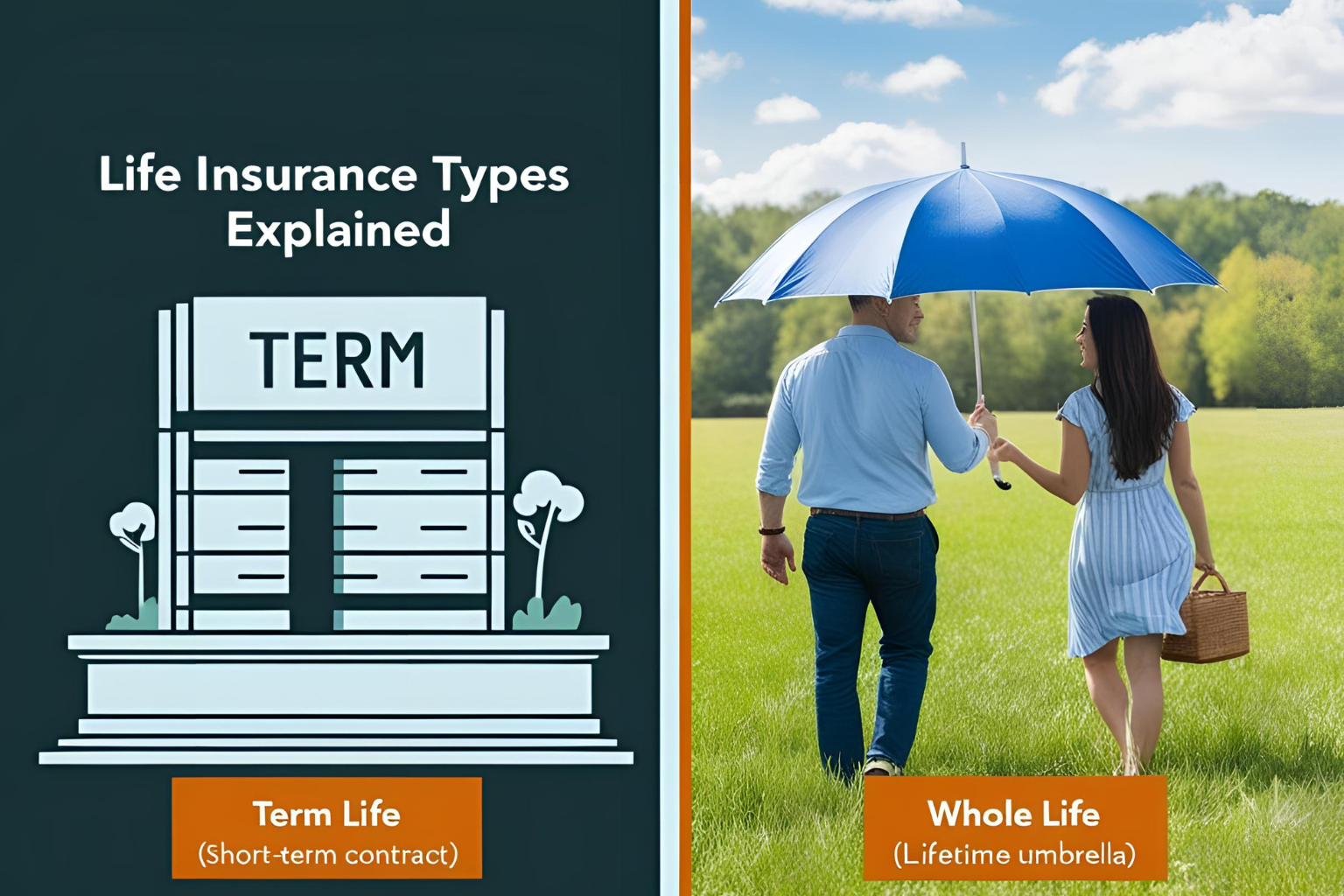

Life Insurance Types Explained: Term vs Whole Life

Choosing the right life insurance can be confusing, especially when deciding between term life and whole life insurance. Both options serve to protect your loved ones, but they function very differently.

In this guide, we’ll explain how each type works, the pros and cons of each, and how to decide which is best for your needs.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period—usually 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a tax-free payout (death benefit).

- Affordable premiums

- No cash value component

- Expires at the end of the term (unless renewed)

Best for: Income replacement during working years, mortgage coverage, raising children.

What Is Whole Life Insurance?

Whole life insurance provides lifetime coverage and includes a cash value savings component that grows over time.

- Fixed premiums

- Builds cash value you can borrow against

- Guaranteed payout, as long as premiums are paid

Best for: Long-term estate planning, high-net-worth individuals, or those wanting permanent coverage.

Term vs Whole Life: Key Differences

| Feature | Term Life | Whole Life |

|---|---|---|

| Duration | 10–30 years | Lifetime |

| Premiums | Lower | Higher |

| Cash Value | No | Yes |

| Death Benefit | If death occurs during term | Guaranteed (as long as active) |

| Cost | Budget-friendly | Expensive |

| Investment Component | None | Yes, but grows slowly |

Pros and Cons of Term Life

Pros:

- Affordable

- Simple to understand

- Great for temporary needs

Cons:

- No cash value

- Coverage ends if outlived

Pros and Cons of Whole Life

Pros:

- Lifetime coverage

- Cash value accumulation

- Fixed premiums

Cons:

- Expensive

- Complexity

- Lower investment returns compared to alternatives

Which One Should You Choose?

Choose Term Life if:

- You need coverage for a specific period

- You want low monthly premiums

- You plan to invest your savings elsewhere

Choose Whole Life if:

- You want permanent coverage

- You need forced savings or cash value

- You’re focused on estate planning

Final Thoughts

There’s no one-size-fits-all answer in life insurance. Term life is best for most people due to its affordability, while whole life may suit those with long-term financial planning needs. Understanding the trade-offs helps you make a smart choice for your future.

FAQs

Is term life insurance a waste of money?

No. While it doesn’t build cash value, it provides essential financial protection at a low cost.

Can I convert term life to whole life?

Many policies allow conversion during a specific period—check with your insurer.

What happens if I outlive my term life policy?

Your coverage ends unless you renew or buy a new policy.

Can I cash out a whole life policy?

Yes, you can access the cash value, but it may reduce the death benefit.

Do I need life insurance if I’m single?

If no one depends on your income, you may not need it—but it can still help cover final expenses or debts.